lexandrasev.ru Overview

Overview

0 Apr Visa

Browse Citi's credit cards that have a 0% Intro APR. Find the best 0% Intro APR credit card for you. Discover U.S. News' picks for the best balance transfer cards. Find the best 0% APR and low interest card offers to save money and pay off your debt. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. Introductory rates as low as 0% APR applies for 12 months on purchases and balance transfers after account opening. Then, a low standard variable rate applies. With a Visa® Business Credit Card from PNC you can enjoy 0% APR on balance transfers for the first 13 billing cycles. Apply online today! A 0% intro balance transfer APR credit card means that customers won't be charged interest on their qualifying balance transfers for a specified period of time. Find a top zero-interest credit card in to help finance big purchases and manage debt without paying interest with Bankrate. The Chase Freedom Flex's long 0% APR period, generous sign-up bonus and ongoing rewards program could net you thousands in interest savings and cash back. A 0% intro APR credit card from Wells Fargo allows you to use your low intro APR to help pay for unexpected expenses or big-ticket purchases. Browse Citi's credit cards that have a 0% Intro APR. Find the best 0% Intro APR credit card for you. Discover U.S. News' picks for the best balance transfer cards. Find the best 0% APR and low interest card offers to save money and pay off your debt. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. Introductory rates as low as 0% APR applies for 12 months on purchases and balance transfers after account opening. Then, a low standard variable rate applies. With a Visa® Business Credit Card from PNC you can enjoy 0% APR on balance transfers for the first 13 billing cycles. Apply online today! A 0% intro balance transfer APR credit card means that customers won't be charged interest on their qualifying balance transfers for a specified period of time. Find a top zero-interest credit card in to help finance big purchases and manage debt without paying interest with Bankrate. The Chase Freedom Flex's long 0% APR period, generous sign-up bonus and ongoing rewards program could net you thousands in interest savings and cash back. A 0% intro APR credit card from Wells Fargo allows you to use your low intro APR to help pay for unexpected expenses or big-ticket purchases.

0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that. Zero-interest credit cards can be a big help. Here's everything you need to know to make them work for you. U.S. Bank Triple Cash Rewards VISA® Business Card. Get a 0% intro APR period of 15 months for purchases and cash advances along with cash back rewards, and a. How to Finance a Disney Vacation with Your Disney® Visa® Credit Card. Receive a promotional APR of 0% for 6 months on select Disney vacation packages, Disney. Some credit cards offer an introductory period – often 12 to 18 months – with 0% interest on purchases and, potentially, balance transfers. Discover how 0% and low APR credit cards can help boost your credit. Save more on interest fees with our zero percent APR credit cards. Explore Mastercard credit cards to find the right card for your lifestyle needs. 8 best 0% APR and low-interest credit cards of August · Capital One VentureOne Rewards Credit Card: Best for travel · Blue Cash Preferred® Card from American. Apply for a CommunityAmerica credit card and pay no interest for 18 months, earn great rewards and enjoy no annual fee. Apply Today! A zero-percent or 0% APR credit card saves you money by stopping the clock on interest for a year or more. Got a big expense coming up? American Express helps you save with 0% intro APR Credit Cards offers. Compare our cards and different benefits to find the one that works for you best. Take advantage of no interest payments. Get matched to intro 0% APR credit cards from our partners based on your unique credit profile. Introductory 0% † APR for your first 18 billing cycles for purchases, and for any balance transfers made within 60 days of opening your account. After the intro. 0% intro APR credit cards: 0% intro APR on purchases for months. Then % - % Standard Variable Purchase APR applies. Offers vary based on card. Get the lowest possible intro rate for over a year with a Capital One low intro APR credit card. Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of % - %. No annual fee. American Express helps you save with 0% intro APR Credit Cards offers. Compare our cards and different benefits to find the one that works for you best. 0% intro APR on purchases and balance transfers for 15 months; % - % variable APR after that; balance transfer fee applies. A 0% intro balance transfer APR credit card means that customers won't be charged interest on their qualifying balance transfers for a specified period of time.

Index Funds To Purchase

An index fund will attempt to achieve its investment objective primarily by investing in the securities (stocks or bonds) of companies that are included in a. INFORMATION REGARDING MUTUAL FUNDS/ETF: Investors should carefully consider the investment objectives and risks as well as charges and expenses of a mutual. Learn about the advantages of investing in index funds. Get low-cost market cap index mutual funds with no minimums. Active or index investing isn't an either-or proposition. In fact, many mutual fund companies offer both types of funds, and many investors choose to use both. Exchange-Traded funds. Most exchange-traded funds (ETFs) are designed to track the performance of a particular market index (such as the S&P or the NASDAQ. What are the advantages? These funds charge significantly lower fees to investors than active funds. The reason is simple: the asset manager does not need to. S&P index funds trade through brokers and discount brokers and may be accessed directly from the fund companies. Investors may also access ETFs and mutual. 1Efficient access– There's an index, and an index fund, for almost every market exposure and investment strategy you can possibly need. More choice gives. That's why you may hear people refer to indexing as a "passive" investment strategy. Instead of hand-selecting which stocks or bonds the fund will hold, the. An index fund will attempt to achieve its investment objective primarily by investing in the securities (stocks or bonds) of companies that are included in a. INFORMATION REGARDING MUTUAL FUNDS/ETF: Investors should carefully consider the investment objectives and risks as well as charges and expenses of a mutual. Learn about the advantages of investing in index funds. Get low-cost market cap index mutual funds with no minimums. Active or index investing isn't an either-or proposition. In fact, many mutual fund companies offer both types of funds, and many investors choose to use both. Exchange-Traded funds. Most exchange-traded funds (ETFs) are designed to track the performance of a particular market index (such as the S&P or the NASDAQ. What are the advantages? These funds charge significantly lower fees to investors than active funds. The reason is simple: the asset manager does not need to. S&P index funds trade through brokers and discount brokers and may be accessed directly from the fund companies. Investors may also access ETFs and mutual. 1Efficient access– There's an index, and an index fund, for almost every market exposure and investment strategy you can possibly need. More choice gives. That's why you may hear people refer to indexing as a "passive" investment strategy. Instead of hand-selecting which stocks or bonds the fund will hold, the.

An index fund (also index tracker) is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that it can replicate the. Index funds are investment funds that follow a benchmark index, such as the S&P or the Nasdaq When you put money in an index fund, that cash is then. A straightforward, low-cost fund with no investment minimum · The Fund can serve as part of the core of a diversified portfolio · Simple access to leading. You can purchase index funds through a brokerage firm or the fund provider's website. Most people opt for the former since this will give you more investment. Index funds are pooled investments that passively aim to replicate the returns of market indexes. The first retail S&P Index-tracking fund was founded in The chart shows how much a hypothetical $10, investment in the five equity-focused American. The Nuveen S&P Index Fund seeks total return by investing primarily in a portfolio of large cap equities selected to track U.S. equity markets based on. Index funds are investment funds that follow a benchmark index, such as the S&P or the Nasdaq When you put money in an index fund, that cash is then. The updated Second Edition of Richard Ferri's bestselling All About Index Funds offers individual investors an easy-to-use guide for capitalizing on one of. They generally invest primarily in the component securities of the index and typically have lower management fees than actively managed funds. Some index funds. What index funds should I consider buying on Fidelity? The Fidelity Index fund looks pretty good to me but could use some advice. An index funds tracks the stock market as a whole. Instead of having a well-paid person on Wall Street choosing which stocks to buy, an index fund simply buys. Get information about what index funds are, index fund verticals, and funds you can invest in on Public. Join Public to buy stock in any amount with no. If you're looking for a passive investment strategy with low fees, index funds can be a good option. They're designed to track and perform like market indices. Many well-known and prominent people in our society are ardent believers in index funds. Here are just a few: Warren Buffett, American investor, philanthropist. Investing in an index fund means you're subject to market performance, even when markets fall. What are other factors to consider when choosing an index mutual. Passively managed funds invest by sampling the index, holding a range of securities that, in the aggregate, approximates the full Index in terms of key risk. Now, indexed ETFs have further expanded the popularity and flexibility of index investing. Vanguard, the world's largest index fund company, now has over $5. Index funds purchase all the stocks in the same proportion as in a particular index. Check out the list of top performing index mutual funds and invest. When an investor invests in an index fund, he buys a blend of investments that mimics the makeup of a market index. The investors can buy all these assets in.

Should I Get A Costco Credit Card

If the credit has been earned, we should be able to use it immediately to lower any balance. It's weird that everything is held until February. If you have a Costco membership and shop at Costco regularly, the Costco Anywhere Visa Card is a worthwhile card to consider. With a solid rewards structure. Bottom Line The Costco Credit Card is worth it for Costco members with excellent credit, especially those who spend a lot of money on gas, travel and dining. It. Did you know the CITI/Costco VISA credit card eliminated the 3% foreign transaction fee? Also, it includes 3% cash back rewards for restaurants and eligible. The points given are the equivalent of 1% so I am giving up 1% by using this card instead of the Costco visa but getting 2 years of extra. With no annual fee and fantastic rewards rate, this credit card is an excellent option for earning valuable cash rewards with every purchase. The Good. You won'. 1. It has a robust rewards program · 2. Costco purchases don't earn the highest cash-back rate · 3. You can only collect rewards once a year · 4. You have to be a. The Costco Anywhere Visa® Card by Citi is a solid choice if you're an existing Costco member and already do most of your shopping there. It offers a high cash. Cash back rewards. Shopping at Costco can be more rewarding. Costco members can earn cash back rewards with a Costco Anywhere Visa Card by Citi. If the credit has been earned, we should be able to use it immediately to lower any balance. It's weird that everything is held until February. If you have a Costco membership and shop at Costco regularly, the Costco Anywhere Visa Card is a worthwhile card to consider. With a solid rewards structure. Bottom Line The Costco Credit Card is worth it for Costco members with excellent credit, especially those who spend a lot of money on gas, travel and dining. It. Did you know the CITI/Costco VISA credit card eliminated the 3% foreign transaction fee? Also, it includes 3% cash back rewards for restaurants and eligible. The points given are the equivalent of 1% so I am giving up 1% by using this card instead of the Costco visa but getting 2 years of extra. With no annual fee and fantastic rewards rate, this credit card is an excellent option for earning valuable cash rewards with every purchase. The Good. You won'. 1. It has a robust rewards program · 2. Costco purchases don't earn the highest cash-back rate · 3. You can only collect rewards once a year · 4. You have to be a. The Costco Anywhere Visa® Card by Citi is a solid choice if you're an existing Costco member and already do most of your shopping there. It offers a high cash. Cash back rewards. Shopping at Costco can be more rewarding. Costco members can earn cash back rewards with a Costco Anywhere Visa Card by Citi.

If you want to enter and pay with the same card in the US, sign up for the Costco Visa they're forever plugging. Walk in and it should be pretty. This card is best for business owners who are also Costco fans and frequently shop at the wholesale retailer since you do need an active membership to apply for. If you have received your Costco Anywhere Visa® Card by Citi but are unable Safari users should check cookie settings each time they use Safari to. On June 20, Costco is changing credit cards from Amex to Citibank. If you have Costco business membership, you must have a business card. With the new Costco Anywhere Visa® Cards by Citi, exclusive to Costco members, earn cash back rewards for personal or business purchases. Online sign-ups at lexandrasev.ru must upgrade to the Executive Membership within the first 30 days of sign-up, apply for the Costco Anywhere Visa® Card by Citi or. If you're a Costco Executive Member and also have the Costco Anywhere Visa® Card by Citi, you're automatically enrolled in two reward programs. But how do you. The Climate Problem with Costco's Banking & Credit Card. We've got the receipts on Citi: Citi is the second biggest funder in the world of dirty fossil fuels. Cashback rewards are distributed yearly as a certificate in February. You must visit your local Costco store to redeem them before your Costco membership. The Citi Double Cash® Card requires fair to excellent credit for approval, and they may just receive a five-digit credit limit. The card should appeal to folks. The Costco Anywhere Visa offers 2% - 4% cash back in those spending categories, and it's easily worthwhile, thanks to a $0 annual fee. Costco membership will. Purchase Rate: % Variable APR. Use the Costco Anywhere Visa card as your Costco membership ID. Redeeming Costco Cash Rewards: Cash back will be provided as. The card has travel-related benefits, including no foreign transaction fee. You'll get strong bonus earnings on Costco purchases, gas, dining out and travel. Costco Anywhere Visa® Card by Citi · Cash Back · Dining · Excellent Credit · Gas · No Foreign Transaction Fees · Rewards · Travel. "The cash back on this card is the best we have found for everyday purchases. We have tripled our annual cash back from our previous credit card thanks to. You receive a lower bonus rate on purchases from Costco and lexandrasev.ru and a standard cash back rate for all other purchases. Costco Anywhere Visa® Card by Citi. Do I need to get the Costco Anywhere Visa® Card by Citi in order to shop at. Costco's credit cards are issued by Citi – one of the dirtiest banks on the planet. Citi pumps billions into building new oil, gas, and coal projects that are. This cash-back card doesn't have an annual fee, but you'll need a Costco membership to apply. There are two levels of Costco membership which cost $60 or $ Costco Anywhere Visa cardholders can also use their card to earn rewards at any qualifying gas station (note that gas purchases at superstores, supermarkets.

90 Cltv Home Equity Loan

To calculate CLTV, follow these steps: Add your loan balances together. Divide that amount by your home's value. CLTV calculation example. Following our earlier. Home Equity Line Of Credit (HELOC) 90% CLTV Just did some research today on this since I have a lot of equity in my home, and thought I would share what I. Lenders have specific credit score and income requirements for HELOC applicants. A credit score of at least is often necessary for a 90% LTV HELOC, as per. loan-to-value (CLTV) of your property. A Wescom HELOC fixed rate conversation (FRC) option allows members with a new or existing HELOC to convert a portion. Home Equity Line of Credit. Make your home equity work harder for you Maximum loan amount is $, up to 90% CLTV. The maximum variable Annual. Payments are calculated based on month end loan balance. Fixed rate loans for up to 30 years with up to 90% loan-to-value (LTV)* financing. Home Equity. No annual fee; no application fee; Borrow up to $,, or up to 90% of your home's equity, whichever is less; Borrow up to months; No pre-payment. Loan-To-Value (LTV) (0% to 90%). Calculate. This information may help you HELOC for the most qualified applicant at CLTV up to 80%. Not all. We have HELOC rates as low as % APR1 for up to 80% CLTV2, as well as % APR1 for up to 90% CLTV2. Get Started Calculators. To speak to a Credit Union of. To calculate CLTV, follow these steps: Add your loan balances together. Divide that amount by your home's value. CLTV calculation example. Following our earlier. Home Equity Line Of Credit (HELOC) 90% CLTV Just did some research today on this since I have a lot of equity in my home, and thought I would share what I. Lenders have specific credit score and income requirements for HELOC applicants. A credit score of at least is often necessary for a 90% LTV HELOC, as per. loan-to-value (CLTV) of your property. A Wescom HELOC fixed rate conversation (FRC) option allows members with a new or existing HELOC to convert a portion. Home Equity Line of Credit. Make your home equity work harder for you Maximum loan amount is $, up to 90% CLTV. The maximum variable Annual. Payments are calculated based on month end loan balance. Fixed rate loans for up to 30 years with up to 90% loan-to-value (LTV)* financing. Home Equity. No annual fee; no application fee; Borrow up to $,, or up to 90% of your home's equity, whichever is less; Borrow up to months; No pre-payment. Loan-To-Value (LTV) (0% to 90%). Calculate. This information may help you HELOC for the most qualified applicant at CLTV up to 80%. Not all. We have HELOC rates as low as % APR1 for up to 80% CLTV2, as well as % APR1 for up to 90% CLTV2. Get Started Calculators. To speak to a Credit Union of.

Loan Option is $5, and the maximum amount that can be converted is limited to 90% of the maximum line amount. The minimum loan term is 1 year, and the. Lock in your rate with Discover on a home equity loan between $35, and $, up to 90% combined loan-to-value (CLTV). Low Fixed Rates. Fixed Repayment. CLTV up to 90% on loan amounts ranging from $, $, Mortgage insurance approval may be required. Maximum loan amount up to $50, for investment/. The maximum CLTV on home equity loan is 90%. For loans with a CLTV greater than 70%, higher rates will apply. The Annual Percentage Rate (APR) for a fixed rate. Home Equity Loan1. $10, minimum. 8 years (up to 90% max CLTV). %. $10, minimum. 15 years (up to 90% CLTV). %. Home Equity Line of Credit (HELOC)2. Rates are as low as % APR and are based on an evaluation of credit history, CLTV (combined loan-to-value) ratio, loan amount, and occupancy, so your rate. Home Equity Line Of Credit (HELOC) 90% CLTV Just did some research today on this since I have a lot of equity in my home, and thought I would share what I. HELOC loans are available up to 90% CLTV on a family home and up to 85% CLTV on condominiums/townhomes, in first or second lien positions. The maximum CLTV. 90% LTV will likely have a margin. Look into home equity loans also - if you're looking to borrow $k it may make sense to check those. ^ APR=Annual Percentage Rate. Rates valid as of 09/01/ Max CLTV 90%. For $10, closed end Home Equity Loan with a term of 60 months at % APR and an LTV. Minimum home equity line of credit: $10, Up to 90% combined loan-to-value (CLTV): the maximum CLTV up to 90% varies upon borrower's credit score, requested. Up to 90% LTV with a current appraisal. Other restrictions may apply. Call a loan officer for further details. 4 These are our posted rates; your rate could. loan-to-value (LTV) ratio (including prior mortgages or liens) of 90% or less. Initial rate is fixed for 6 months following account opening date, and is not. CLTV up to 90% on loan amounts ranging from $, $, Mortgage insurance approval may be required. Maximum loan amount up to $50, for investment/. [2] Equity loans up to 90% of home value. Loans over 80% of home value 2 Up to 90% Combined-Loan-To-Value (CLTV). Must draw $15, or 40% of your. Turn to Northwest for a home equity loan or home equity line of credit $, maximum loan amount (up to 90% CLTV)1 $, maximum loan amount. For example, if your home is worth $, and you owe $, on your mortgage, your LTV is 50%. Lenders typically cap the LTV ratio for HELOCs at 85% to 90%. For example, if your home is worth $, and you owe $, on your mortgage, your LTV is 50%. Lenders typically cap the LTV ratio for HELOCs at 85% to 90%. Get more with up to 90% LTV on a home equity loan or HELOC from your local Washington-based credit union. Some lenders let you tap up to 90 percent of your home's value. Others cap that amount at 80 percent. Determine your debt-to-income ratio: all your current.

Cheap State Required Car Insurance

Auto Insurance Rates Are You Getting the Best Deal on Insurance? ; Liberty Mutual, $ ; Nationwide, $ ; State Farm, $ ; Travelers, $ Most banks or lenders require you to buy this coverage to receive a car loan. automobile insurance, if your carrier offers such a discount. Pennsylvania. Allstate provides affordable car insurance options based on your needs. Whether you want to bundle your home and car insurance (multi-line), insure more. With Allstate, you'll enjoy quality protection and affordable car insurance. coverage. Quality property. Auto insurance is an essential type of personal insurance. In most states, it is mandatory to have some form of insurance to legally drive. What can I do to get cheap car insurance? · Shop around · Buy the right coverage · Drive responsibly · Pay on time · Bundle up · Be safe, not sorry · Stick with one. The minimum requirement for mandatory auto insurance in New Brunswick is $, in Third Party Liability (Section A), Direct Compensation – Property Damage . Car insurance is mandatory in almost every state. State minimums and coverage types vary, but nearly all states that mandate insurance require liability. We have discounts and offers to get you a better price for your car insurance. Find out which ones you qualify for. Double Contract discount for home and. Auto Insurance Rates Are You Getting the Best Deal on Insurance? ; Liberty Mutual, $ ; Nationwide, $ ; State Farm, $ ; Travelers, $ Most banks or lenders require you to buy this coverage to receive a car loan. automobile insurance, if your carrier offers such a discount. Pennsylvania. Allstate provides affordable car insurance options based on your needs. Whether you want to bundle your home and car insurance (multi-line), insure more. With Allstate, you'll enjoy quality protection and affordable car insurance. coverage. Quality property. Auto insurance is an essential type of personal insurance. In most states, it is mandatory to have some form of insurance to legally drive. What can I do to get cheap car insurance? · Shop around · Buy the right coverage · Drive responsibly · Pay on time · Bundle up · Be safe, not sorry · Stick with one. The minimum requirement for mandatory auto insurance in New Brunswick is $, in Third Party Liability (Section A), Direct Compensation – Property Damage . Car insurance is mandatory in almost every state. State minimums and coverage types vary, but nearly all states that mandate insurance require liability. We have discounts and offers to get you a better price for your car insurance. Find out which ones you qualify for. Double Contract discount for home and.

Minimum Auto Insurance Requirements in Florida. All drivers must comply with the state's minimum car insurance requirements. Here's the bare minimum you need. Are optional car insurance coverages available in Missouri? In addition to these state-required coverages, you can also choose to purchase additional coverage. That's one of the reasons how we can deliver affordable rates and first-class coverage to you and all our policyholders. If you're looking for cheap auto. Unlicensed companies are not required to comply with state insurance laws or discount by having all your insurance serviced by one insurance provider. Cheapest car insurance in Arkansas · Arkansas car insurance laws. California Cheap car insurance in the Pine Tree State may be due to the state's low. Tailor your car insurance to get coverage at the right price. Choose from our Double Contract discount for home and car. Get up to 15% off your home. What auto insurance coverage is required in SC? Is a person required to Affordable Care Act · Information for Small Businesses · Rate Review Filings. Getting the right vehicle insurance at a great price is important and we can help. Liability coverages. These required coverages are set by the state you live. Can I require the insurance company to replace my vehicle? The personal vehicle discount, good student discount, nonsmokers discount, or passive. Is car insurance mandatory in Canada? Yes! You must have car insurance Life as a new driver isn't cheap. New Brunswick has a unique discount where. How can I get a discount on car insurance in Ontario? There are numerous ways for you to save on your car insurance premium: Bundle your house and car. The cheapest liability-only car insurance is from State Farm, which also offers the most affordable option for high-risk drivers. Who has the cheapest liability car insurance? USAA and Erie have the cheapest minimum liability car insurance rates, on average. This type of coverage will. " Liability coverage for bodily injury and property damage is required by law in just about every state. "Car Insurance Discount List." lexandrasev.ru ". Who has the cheapest car insurance in Alabama? · $ lower than GEICO · $ lower than Progressive · $ lower than State Farm · $ lower than Allstate. How to save money on auto insurance · 1. Find the cheapest auto insurance company for you · 2. File claims wisely · 3. Choose the correct coverage · 4. Improve your. It also provides coverage for any passengers injured in accidents in New York State while in your vehicle, as well as any guest passengers who are New York. discount programs offered by the company. 8. Department of Commerce. Page How to Shop for Insurance. Decide on the coverage you need and want before you. Finding cheap auto insurance that doesn't compromise on coverage or quality is easy with Progressive. When you get a quote, we'll help you build a policy. Affordable car insurance that covers what you need. Get peace of mind with a Car insurance is mandatory in 48 states. It protects you against.

Which Insurance Is Better Cigna Or Blue Cross Blue Shield

Blue Cross Blue Shield is most highly rated for Compensation and benefits and The Cigna Group is most highly rated for Compensation and benefits. Participating Health Insurance Plans · Blue Cross Medicare Private Fee for Service · Legacy Medigap · Medicare Complementary Coverage · Medicare Plus Blue Group PPO. Cigna appears to have better coverage at % coverage after the deductible however I've always heard BCBS is superior with a wider network and negotiated. Lincoln Memorial Hospital · Aetna/Coventry · BlueCross BlueShield of Illinois HMO/PHAI (Site ) · BlueCross BlueShield of Illinois PPO · Caterpillar, Inc · Cigna. Alliant Health Plans; Anthem; Anthem Blue Cross and Blue Shield; Anthem Blue Cross of California; Arizona Care Network (ACN); Baylor Scott & White Health Plan. Cigna: Open Access Plus Network. Anthem: Blue Cross/Blue Shield PPO Network. Anthem: Blue Cro. In-Network. Out-of-Network1. (based on Maximum Allowable Amount). Cigna is one of the bad insurance company. The claims are rejected with irrelevant reasons. My personnel experience with cigna is not good. They. Which health insurance company is better? We've made it easy to Each state has its own HCSC / Blue Cross Blue Shield app on iTunes and GooglePlay. Blue Cross Blue Shield has strong ratings and offers a variety of quality, affordable health insurance plans, making it our top pick as the best overall. Blue Cross Blue Shield is most highly rated for Compensation and benefits and The Cigna Group is most highly rated for Compensation and benefits. Participating Health Insurance Plans · Blue Cross Medicare Private Fee for Service · Legacy Medigap · Medicare Complementary Coverage · Medicare Plus Blue Group PPO. Cigna appears to have better coverage at % coverage after the deductible however I've always heard BCBS is superior with a wider network and negotiated. Lincoln Memorial Hospital · Aetna/Coventry · BlueCross BlueShield of Illinois HMO/PHAI (Site ) · BlueCross BlueShield of Illinois PPO · Caterpillar, Inc · Cigna. Alliant Health Plans; Anthem; Anthem Blue Cross and Blue Shield; Anthem Blue Cross of California; Arizona Care Network (ACN); Baylor Scott & White Health Plan. Cigna: Open Access Plus Network. Anthem: Blue Cross/Blue Shield PPO Network. Anthem: Blue Cro. In-Network. Out-of-Network1. (based on Maximum Allowable Amount). Cigna is one of the bad insurance company. The claims are rejected with irrelevant reasons. My personnel experience with cigna is not good. They. Which health insurance company is better? We've made it easy to Each state has its own HCSC / Blue Cross Blue Shield app on iTunes and GooglePlay. Blue Cross Blue Shield has strong ratings and offers a variety of quality, affordable health insurance plans, making it our top pick as the best overall.

Blue Cross Blue Shield - Best for Nationwide Coverage. Aetna - Best for Medicare Plans. UnitedHealthcare - Best for Mobile and Online Care. Cigna - Best for. Blue Card plans with no restrictions · Anthem Blue Cross Prudent Buyer PPO · Anthem Blue Cross through employer groups · University of California employee plans. insurance carrier or the office of your choice for details. Aetna; Blue Cross/Blue Shield; Beech Street; Cigna; Corvel; Coventry; Fox Valley Medicine; Great-. Blue Card by BCBS · Cigna Commercial (excludes Marketplace plans) Horizon Blue Cross Blue Shield · Horizon NJ Health · Humana · Independence Blue Cross -. We offer quotes and information about Blue Cross Blue Shield and Cigna Health insurance. You can request online quotes 24 hours or day or call a licensed. Blue Cross Blue Shield of North Carolina (HMO, POS, and PPO plans). CIGNA Only some services and benefits Cigna Healthcare covers are accepted at Duke Health. Employer Plans Contracted With Cedars-Sinai · Aetna · Anthem Blue Cross · Blue Shield of California · Cigna · Cigna + Oscar · Health Net · MultiPlan. Beech Street. Insurance. Cigna to sell Medicare Advantage plans to Blue Cross Blue Shield insurer for $ billion. Bob Herman. By Bob Herman Jan. 31, Health insurance through your employer: PPO insurance ; Aetna ; Anthem Blue Cross ; Blue Shield of California ; Cigna ; First Health. We provide a list of our participating insurance plans Anthem Blue Cross Blue Shield of New Hampshire · Blue Cross Blue Shield of Vermont · Cigna. BlueCross BlueShield of Tennessee and Cigna, our health insurance carriers, administer the medical network options. Both carriers offer expansive networks. Cigna Healthcare offers health insurance plans such as medical and dental to individuals and employers, international health insurance, and Medicare. Blue Cross & Blue Shield Association · Blue Cross & Blue Shield National Transplant Network*; Centivo · Cigna Health Plan Aetna Better Health of PA (Chester. Aetna Better Health, Medicaid. Blue Cross Blue Shield of Texas, HMO, PPO, POS Cigna, Open Access Plus- USAA employees and dependents only. Clover Health. Plans come with mental health benefits and health and wellness programs, and may include spending accounts and pharmacy coverage, as well. Anthem has over 40 million American customers for its Blue Cross Blue Shield health insurance plans, ranking it second in size in the United States. They offer. To confirm coverage of your specific physician or provider, please contact the insurer directly. Aetna; CareFirst BlueCross BlueShield; Cigna Healthcare*; First. Blue Cross Blue Shield of Texas. Product Type, HMO, PPO, POS, Indemnity. Plan Cigna ACA individual plans including Cigna Connect and Cigna Plus. Also known as the Health Insurance Marketplace®, a service that helps individuals, families and small businesses with medical insurance. Anthem Blue Cross Blue. Cigna HealthSpring rates % higher than Horizon Blue Cross Blue Shield of New Jersey on Compensation Culture Ratings vs Horizon Blue Cross Blue Shield of New.

What House Can We Afford

One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. How much can I borrow? Estimate your maximum loan amount in two minutes You can buy a house of: , $. Once you entered your values, click on. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. Find out how much house you can afford with our home affordability calculator. See how much your monthly payment could be and find homes that fit your. Even before you begin searching for your dream house, see how much you can afford by using our free and user-friendly mortgage calculator. The calculation. To get a rough estimate of what you can afford, most lenders suggest you spend no more than 28% of your monthly income — before taxes are taken out — on your. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Find out how much house you can afford with our home affordability calculator. See how much your monthly payment could be and find homes that fit your. Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. How much can I borrow? Estimate your maximum loan amount in two minutes You can buy a house of: , $. Once you entered your values, click on. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. Find out how much house you can afford with our home affordability calculator. See how much your monthly payment could be and find homes that fit your. Even before you begin searching for your dream house, see how much you can afford by using our free and user-friendly mortgage calculator. The calculation. To get a rough estimate of what you can afford, most lenders suggest you spend no more than 28% of your monthly income — before taxes are taken out — on your. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Find out how much house you can afford with our home affordability calculator. See how much your monthly payment could be and find homes that fit your. Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations.

How much home can I afford? Buying a house requires a budget. You can only afford to spend so much on your monthly mortgage payments. Your loan amount and. Use our new house calculator to determine how much of a mortgage you may be able to obtain. Income and Debt Obligations. How much home can I afford? Buying a house requires a budget. You can only afford to spend so much on your monthly mortgage payments. Your loan amount and. How much Mortgage can I afford? When shopping for a new home, it can be helpful to have a good understanding of how much you can afford. Many factors can. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources. Understand how much house you can afford. This mortgage affordability calculator provides an idea of your target purchase price, and it's based on some. How much house can I afford? · Learn the difference between a mortgage prequalification and mortgage preapproval. · This narrated video helps explain what you can. Use PrimeLending’s home affordability calculator to determine how much house you can afford. Enter your income, monthly debt, and down payment to find a. A good credit report not only impacts how much home you can afford but also helps you qualify for a lower interest rate. What costs do I need to consider when. You may be able to afford a home worth $,, with a monthly payment of $2, Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. Mortgage Affordability Calculator Explore how much house you can afford by entering your annual income or a fixed monthly payment. To receive the most. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford. This home affordability calculator looks at your entire financial situation to help you determine how much you can realistically spend on the home of your. Your total housing payment (including taxes and insurance) should be no more than 32 percent of your gross (pre-taxes) monthly income. The sum of your total. Understand how much house you can afford. This mortgage affordability calculator provides an idea of your target purchase price, and it's based on some. How much house can I afford? This calculator will give you a better idea of how much you can afford to pay for a house and what the monthly payment will be by. How much house can I afford? If you are looking to buy a first home, the Mortgage Affordability Calculator will assist you in determining what you can afford. Use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment. How much you can afford depends on your financial circumstances, such as credit score, down payment size, cash reserves, and debt-to-income ratio.

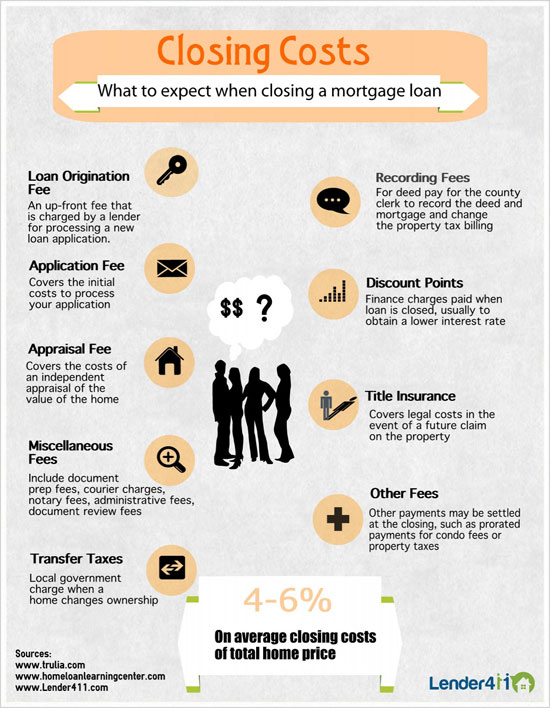

What Is Included In Closing Costs For A Mortgage

Lender fees: This cost can be several percentage points of your total loan amount. Lender fees include an application fee, processing fees, underwriting fees. Closing costs are fees associated with your home purchase that are paid at the closing of a real estate transaction. A fee for obtaining a credit report · A Loan origination fee – the amount the lender charges for processing loan paperwork · Legal fees · Charges for home. These fees can include an origination fee, underwriting fee, application fee, and processing fee. They are part of the cost of obtaining a mortgage and can. Closing costs are the fees associated with finalizing the process, these include realtor commissions, home appraisal, taxes, title-related fees, filing fees. Possible Mortgage Closing Costs · Deposit · Down Payment · Mortgage Loan/Default Insurance Premium · Appraisal Fee · Home Inspection · Land Registration/Tarrif Fee. Yes, closing costs can be included in a mortgage loan. This is also known as “rolling” closing costs into a loan. The downside of rolling closing costs into a. Closing costs can include lawyer fees, property transfer fees (in certain provinces), title insurance, and moving expenses. How much do I budget for closing. Typically, total closing costs range from 2 – 5% of a home's purchase price, although this can vary based on where you live and the property you buy. Lenders. Lender fees: This cost can be several percentage points of your total loan amount. Lender fees include an application fee, processing fees, underwriting fees. Closing costs are fees associated with your home purchase that are paid at the closing of a real estate transaction. A fee for obtaining a credit report · A Loan origination fee – the amount the lender charges for processing loan paperwork · Legal fees · Charges for home. These fees can include an origination fee, underwriting fee, application fee, and processing fee. They are part of the cost of obtaining a mortgage and can. Closing costs are the fees associated with finalizing the process, these include realtor commissions, home appraisal, taxes, title-related fees, filing fees. Possible Mortgage Closing Costs · Deposit · Down Payment · Mortgage Loan/Default Insurance Premium · Appraisal Fee · Home Inspection · Land Registration/Tarrif Fee. Yes, closing costs can be included in a mortgage loan. This is also known as “rolling” closing costs into a loan. The downside of rolling closing costs into a. Closing costs can include lawyer fees, property transfer fees (in certain provinces), title insurance, and moving expenses. How much do I budget for closing. Typically, total closing costs range from 2 – 5% of a home's purchase price, although this can vary based on where you live and the property you buy. Lenders.

Can Closing Costs Be Included in a Mortgage? To give you the short answer, typically no. However, you are probably wondering who usually pays closing costs. Closing costs can run from 1% to 4% of your home purchase price — and they're are on top of your down payment. Calculate yours to avoid 'mortgage-close shock'. Mortgage closing costs are the fees associated with the home buying and lending process. What is included in my closing costs? The types of closing cost. Use SmartAsset's award-winning calculator to figure out your closing costs when buying a home. We use local tax and fee data to find you savings. Unless you're refinancing an existing mortgage, closing costs can't usually be included in your mortgage balance. View the full details at CU SoCal. They can include charges for appraisals, prepaid property taxes, and loan origination fees. Both buyers and sellers can be subject to closing costs, but buyers. It also protects the lender from issues too. These fees include the title search fee and title insurance fees. Title fees also include the cost to record and. Closing costs include real estate agent commissions, legal fees, appraisal fees and more. They can range anywhere from % of the house's purchase price. Like the down payment and appraisal, closing costs represent another upfront expense you'll need to pay before moving in to your new home. One-time closing costs include origination, appraisal, notary, and recording fees. Property taxes, homeowners' insurance, and mortgage insurance premiums are. Home-buying closing costs can include attorney fees, property appraisals, and mortgage fees. Sometimes these are fixed costs, and other times they're. What Are Closing Costs? · Common fees · Items paid in advance · Initial escrow payment (for reserve) · Title charges and related expenses · Government recording and. What are Real Estate Closing Costs? · Property Appraisal: · Land Survey Certificate: · House Insurance: · Title Insurance: · Mortgage Default Insurance: · Payout. Closing costs include all legal, administrative and real estate related expenses you'll be responsible for paying in order to finalize the purchase or sale of. These costs may include title insurance, legal fees, and land transfer tax. Use our Mortgage Calculator to get an estimation of the closing costs of your. Closing costs generally referred to as Land Transfer Tax, Real Estate Lawyer Fees, Expenses, and Costs that would need to be paid at the time of home purchase. These costs typically include appraisal fees, title insurance, attorney fees, and prepaid items like property taxes and homeowner's insurance. These costs include items such as fees for processing, title insurance/search (title closing fee), mortgage taxes, appraisals, closing, and more. If you're buying a new build, you can expect to pay a 5% GST (Goods & Services Tax). Typically, this is included in the contract price so it shouldn't be a. 1) The lender. All mortgage lenders charge fees related to issuing a mortgage loan. · 2) State and local government fees. These may include recording fees.

Best Energy Penny Stocks Today

Energy Stocks Under $1 ; REI, , , ; HUSA, , , The best performing penny stock for this year is Sanarco Funds (SNCF) with a total return of 9,% over the past 12 months, followed by Spectral Capital. Top Penny Stock Gainers ; CURR. Currenc Group ; FLUX. Flux Power Holdings ; GRYP. Gryphon Digital Mining ; BKSY. BlackSky Technology. best energy stocks. Energy Stocks · Featured · Investing · Stock Market Today · Stocks to Watch Prices of penny stocks, cryptocurrencies and other financial. 30 Symbols · BTG%. B2Gold Corp. · PLUG%. Plug Power Inc. · PTON%. Peloton Interactive, Inc. · OPEN%. Opendoor Technologies Inc. Best Penny Stocks · 1. Guj. Toolroom, , , , , , , , , , · 2. Franklin Indust. , Top Green Energy Penny Stocks · Ocean Power Technologies Inc. (NASDAQ: OPTT) · KULR Technology Group Inc (AMEX: KULR) · FuelCell Energy Inc . Non-energy minerals, —. Love in every #TradingView. 60M+. Traders and investors use our platform. #1. Top website in the world when it comes to all things. Power Sector Penny Stocks in India · NHPC Ltd. · Jaiprakash Power Ventures Ltd. · Reliance Power Ltd. · RattanIndia Power Ltd. · GMR Power and Urban Infra Ltd. Energy Stocks Under $1 ; REI, , , ; HUSA, , , The best performing penny stock for this year is Sanarco Funds (SNCF) with a total return of 9,% over the past 12 months, followed by Spectral Capital. Top Penny Stock Gainers ; CURR. Currenc Group ; FLUX. Flux Power Holdings ; GRYP. Gryphon Digital Mining ; BKSY. BlackSky Technology. best energy stocks. Energy Stocks · Featured · Investing · Stock Market Today · Stocks to Watch Prices of penny stocks, cryptocurrencies and other financial. 30 Symbols · BTG%. B2Gold Corp. · PLUG%. Plug Power Inc. · PTON%. Peloton Interactive, Inc. · OPEN%. Opendoor Technologies Inc. Best Penny Stocks · 1. Guj. Toolroom, , , , , , , , , , · 2. Franklin Indust. , Top Green Energy Penny Stocks · Ocean Power Technologies Inc. (NASDAQ: OPTT) · KULR Technology Group Inc (AMEX: KULR) · FuelCell Energy Inc . Non-energy minerals, —. Love in every #TradingView. 60M+. Traders and investors use our platform. #1. Top website in the world when it comes to all things. Power Sector Penny Stocks in India · NHPC Ltd. · Jaiprakash Power Ventures Ltd. · Reliance Power Ltd. · RattanIndia Power Ltd. · GMR Power and Urban Infra Ltd.

More Collections > ; img GVK Power & Infrastructure Ltd. ₹ Small Cap ; img Sakuma Exports Ltd. ₹ Small Cap ; img Sarveshwar Foods Ltd. ₹ Small Cap. Top energy sector stocks to watch. Exxon Mobil (XOM), Chevron (CVX) and Schlumberger (SLB) are some of the most trending stocks in the energy sector. +%, M, , M GBP, —, —, —, %, Non-energy minerals, —. M Top website in the world when it comes to all things investing. M+. Mobile. Quick Look at the Best Energy Penny Stocks: · Gevo Inc. · Clean Vision Corp · SunWorks, Inc. · Denison Mines Corp · PEDEVCO Corp · Meta Materials, Inc. Best penny stocks · iQIYI Inc. (IQ). · Geron Corp. (GERN). · lexandrasev.ru (TBLA). · Archer Aviation Inc. (ACHR). · Navitas Semiconductor Corp. (NVTS). · Nuvation Bio. Best penny stocks · iQIYI Inc. (IQ). · Geron Corp. (GERN). · lexandrasev.ru (TBLA). · Archer Aviation Inc. (ACHR). · Navitas Semiconductor Corp. (NVTS). · Nuvation Bio. stocks that appear cheap but are cheap for a reason. Global volatility What one has to focus upon is stock selection and own good business and. Today's Investing News. View the latest top Barchart Exclusives stories, with a focus on today's important stocks, ETFs, and commodity market news. Want to. More Hot Penny Stocks ; TNXP, Tonix Pharmaceuticals Holding Corp. 12,, ; EJH, E-Home Household Service Holdings Limited, 12,, ; MLGO, MicroAlgo. NTPC Ltd is the Best Power Stock as it has the highest market cap. Is it good to buy power stocks? Investing in energy stocks can be risky for those investing. The future of energy is solar power. Solar penny stocks may be an efficient and low-cost way for investors to test the market. good bet to invest in the ailing Walter Energy Co. After all, Walter Energy had traded as high as $ a share in But those who bought Walter Energy. The top energy stocks for September based on day returns include Sunnova Energy International (NOVA), Viper Energy (VNOM), and Clearway Energy (CWEN). Top energy sector stocks to watch. Exxon Mobil (XOM), Chevron (CVX) and Schlumberger (SLB) are some of the most trending stocks in the energy sector. CBAT. CBAK ENERGY TECHNOLOGY INC. 71 ; RAYA. ERAYAK POWER SOLUTION GROUP INC. Best Stocks to Buy Today · Best Small-cap Stocks to Buy · Best Bluechip Stocks to Buy · Guide to Penny Stocks · How to Invest in the Share Market · Warren. Should the market appreciate the company's new soon-to-be FDA-approved offering, the stock is expected to climb up. The stock's current rating is a “buy” from. Stocks Under $10 · Outlook Therapeutics Inc OTLK. Price: $ Daily change: N/A · SmartKem Inc SMTK. Price: $ Daily change: N/A · Aurora Mobile Ltd - ADR JG. It continues to claim around 80% today. Intel also remains the biggest player in making CPUs for back-end servers, which are very much in demand to power the. Welcome to Penny Stocks. The Best list of Penny Stocks, Micro-Cap Company News, Penny Stock Investments & The Best Penny Stocks to Buy are on.

The Best Credit Card To Have

Best credit cards for excellent credit · American Express® Gold Card: Best for dining rewards · Blue Cash Preferred® Card from American Express: Best cash-back. Credit Cards for Bad Credit · Capital One Platinum Secured Credit Card · PREMIER Bankcard® Mastercard® Credit Card · Destiny Mastercard® – $ Credit Limit. Find the best credit cards of this September, suited to various financial needs. Choose from top options for different budgets and situations. The Capital One Quicksilver Cash Rewards card is our best overall credit card and best for cash back because of its combination of low fees, low interest, and. Learn how you can earn Rapid Rewards® points with the SOUTHWEST RAPID REWARDS™ Credit Card when traveling, shopping, and dining. Apply today! In most cases, a Canadian dollar credit card is the worst option for Canadian snowbirds planning to spend a significant amount of time in the US. Find the best credit card for your lifestyle and choose from categories like rewards, cash back and no annual fee. Get the most value from your credit card. Answer a few quick questions to find the perfect credit card for you. We choose from of the top travel and cash rewards credit cards based on your. ShopYourWay (SYW) card hands down. I've earned % back overall on about $75, of spending on that card in the last 3 years. Best credit cards for excellent credit · American Express® Gold Card: Best for dining rewards · Blue Cash Preferred® Card from American Express: Best cash-back. Credit Cards for Bad Credit · Capital One Platinum Secured Credit Card · PREMIER Bankcard® Mastercard® Credit Card · Destiny Mastercard® – $ Credit Limit. Find the best credit cards of this September, suited to various financial needs. Choose from top options for different budgets and situations. The Capital One Quicksilver Cash Rewards card is our best overall credit card and best for cash back because of its combination of low fees, low interest, and. Learn how you can earn Rapid Rewards® points with the SOUTHWEST RAPID REWARDS™ Credit Card when traveling, shopping, and dining. Apply today! In most cases, a Canadian dollar credit card is the worst option for Canadian snowbirds planning to spend a significant amount of time in the US. Find the best credit card for your lifestyle and choose from categories like rewards, cash back and no annual fee. Get the most value from your credit card. Answer a few quick questions to find the perfect credit card for you. We choose from of the top travel and cash rewards credit cards based on your. ShopYourWay (SYW) card hands down. I've earned % back overall on about $75, of spending on that card in the last 3 years.

Choose personal, business, cashback, travel, rewards credit cards in Canada from TD. Check out the latest offers and Apply Online today! To apply for a credit card online, compare the best credit card offers and rewards. Find the right Mastercard credit card to suit your needs. Sign in to see your best offer. Earn MileagePlus award miles through our great selection of United credit card products from Chase. Platinum X5 Visa · Platinum X5 Visa · Perfect For Maximizing Rewards · Annual Fee†: $95 ; Credit One Bank American Express® Card. Credit One Bank American Express. By Type. All Top Credit Cards · Business Credit Cards ; By Issuer. Citi Credit Cards · Chase Credit Cards ; By Credit Score. Credit Cards For Excellent Credit. Epic credit cards for modern explorers. Earn points anywhere in the world, and use them on awesome experiences. Here are some of the best travel credit cards available right now, whether you're looking for no-fee everyday rewards or luxury benefits for a premium price. 10xTravel's seasoned experts identify and recommend the best credit cards available. Explore our latest top picks for your financial health. Call Have your account number and valid check from a U.S. bank ready when you call. There is no fee when you pay through our automated system. The Bank of America® credit card comparison tool lets you compare credit cards side by side to find the card that's right for your lifestyle. The best credit card overall is the Wells Fargo Active Cash® Card because it gives 2% cash rewards on purchases and has a $0 annual fee. For comparison. Best for unsecured card: Capital One Platinum Credit Card · Best student dining card: Capital One SavorOne Student Cash Rewards Credit Card · Best for students. You have a current balance on a card that you want to pay down. · You have a large purchase to make and need extra time to pay it off. · Earning rewards isn't. If you have a high amount on your recurring transactions per year, then the Scotia Momentum® Visa Infinite* Card would be the best card for your recurring. Choose the credit card that's right for you · Scotiabank Passport® Visa Infinite* Card · Scotia Momentum® Visa Infinite* Card · Scotiabank Gold American Express®. If you have carried balances in the past, or think you are likely to do so, consider credit cards that have the lowest interest rates. These cards typically do. Enjoy Cash Secured credit card Good financial habits help build a brighter future. Plus, earn up to 3% cash back on gas and EV charging and 2% on utilities. Travel Rewards for Good Credit. 6, reviews ; 20, Bonus Miles + No Annual Fee. 6, reviews ; Earn up to $1, in travel bonuses. 10, reviews ; Premium. "Secured" credit cards are often the best choice for anyone trying to establish credit for the first time. A secured card means that a security deposit is. The Discover it® Cash Back credit card is a great choice for people with good to excellent credit. We also offer the Discover it® Miles Travel Card, Discover it.